2025 AI Smart Glasses Industry Deep Dive: The Dawn of Mass Adoption as the "Battle of a Hundred Glasses" Unfolds

I. Industry Explosion: From Tech Exploration to Mass Consumer Adoption

Early AI glasses offered limited functions (calls, music), but today they’ve evolved into multi-modal interactive terminals: supporting real-time translation, large-model conversations, AR navigation, and even payments and health monitoring. Market research shows that the 1,000–3,000 price range dominates, with over 60% of products clustered here, drastically lowering the barrier to entry. For example:

- Shanji AI Selfie Glasses (¥999) sold out 50,000 units in 24 hours;

- Thunderbird Air 4 series (¥1,599–¥1,699) and Xiaomi AI Glasses (starting at ¥1,999) dominate the mass market with affordability.

II. Market Fragmentation: Three Product Types & Tiered Competition

The AI glasses market now features a clear product matrix, catering to diverse use cases:

- AI Audio Glasses (e.g., Jiehuan Glasses at just 30.7g): Lightweight, voice-first designs for daily commutes, priced ¥700–¥2,300.

- AI Camera Glasses (mainstream leader): Integrated cameras for first-person capture (e.g., Ray-Ban Meta sold over 1.8 million units globally), priced ¥1,000–¥2,700, ideal for recording and social sharing.

- AI + AR Glasses (future growth driver): Overlay virtual info via Micro LED/OLED displays (e.g., INMO GO2 supports AR navigation), but limited by tech—heavier (2,400–5,000g) and pricier, targeting pros and enthusiasts.

Price-tier segmentation is equally stark:

- Budget-Friendly: Thunderbird (¥1,599), Xiaomi (¥1,999), Quark AI Glasses (¥3,699, discounted to ¥88 for VIPs) for mass appeal;

- Premium Experience: Meta Ray-Ban Display (799/ ¥5,700),GalaxyXR(1,799.99/~¥13,000) for high-end users, emphasizing immersion and ecosystem synergy;

- Developer-Focused: Samsung-Google’s Galaxy XR, though pricey, prioritizes Android XR system experiments and multi-device connectivity.

III. Tech Arms Race: Chips, Displays & Interaction Upgrades

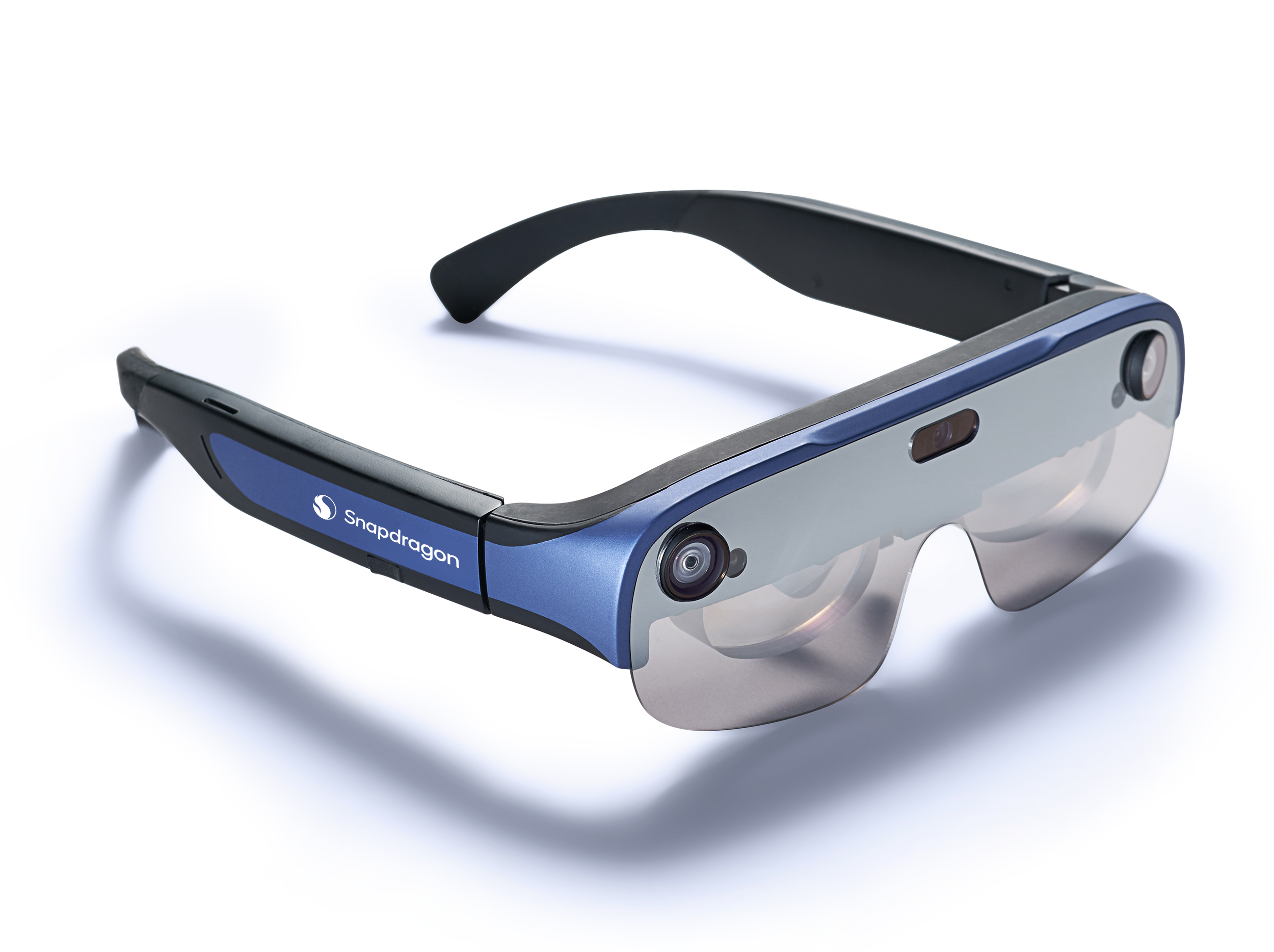

- Chips & Compute Power: Qualcomm’s Snapdragon AR1 chip (54% market share) leads (used in Ray-Ban Meta, Thunderbird V3), balancing performance and power efficiency. Dual-chip solutions (high-performance + low-power) are accelerating. Domestic chips break through: Ingenic’s C200 chip (ultra-low power) powers Thunderbird, Xiaomi, and others, extending battery life.

- Display Tech: AR visuals differentiate premium models. Thunderbird Air 4 series excels in media/game immersion; Waterfall Glasses uses 1D waveguide + Micro LED, delivering 16.7M-color full-spectrum projection and a 120-inch “virtual screen” with superior glare/color control. Dual-eye full-color, HDR (1.07B colors, per Thunderbird RayNeo Air 4 claims) are now standard in high-end models.

- Interaction Innovations: From touch controls to seamless hands-free operation. Galaxy XR integrates Gemini AI, enabling “visual understanding” of on-screen/environmental content via cameras, paired with gesture control (like Meta Ray-Ban’s neural band) and voice commands. Alibaba’s Quark AI Glasses deeply integrate Alipay “Scan-to-Pay,” Amap AR navigation, and more, transforming glasses into ”life assistants.”

IV. Ecosystem Battle: Synergy Wars with Phones, Watches & Wearables

The ultimate edge lies in ecosystem integration. The Samsung-Google alliance leads: Galaxy XR syncs with Wear OS watches, smart rings, etc., creating a ”phone-glasses-wearables” seamless loop. Example: phones handle heavy compute, filtering key info; watches act as secondary displays.

Chinese players accelerate layouts:

- Alibaba Quark AI Glasses: Tied to Alipay, Amap, Taobao for payments, navigation, and price comparisons;

- Thunderbird Innovation: Customized LLMs with Alibaba Cloud for faster AI responses;

- Inmoon Tech: Partners with China Mobile to expand translation/office channels.

This “1+N” model (glasses as core, linking phones, smart homes, cars) will be the moat of future competition.

V. Challenges & Future: From Viral Hits to Full-Scenario Penetration

Despite promise, hurdles remain:

- Tech Limits: AR display miniaturization and battery life aren’t fully solved (premium AR glasses often weigh more than regular specs);

- User Habits: Mass adoption of “glasses-as-interface” needs cultivation;

- Privacy Concerns: Cameras and AI listening raise data security worries.

Future Trajectories:

- Short-Term (2025–2026): Camera + AR become standard; lightweight, long battery life win;

- Mid-Term (2026–2027): AI and ecosystem upgrades make glasses ”personal AI agents“, integrating food delivery, ride-hailing, etc.;

- Long-Term: Multi-modal interactions (eye/gesture control) + VR/MR fusion may challenge smartphones (e.g., Inmoon aims to replace tablets in 2 years, phones in 5).

Conclusion: Behind the "Battle of a Hundred Glasses" Lies the Endgame

2025’s AI glasses market is both a battlefield for giants (Thunderbird, Xiaomi, Samsung, Google) and an opportunity window for startups. From Thunderbird/Xiaomi’s affordability push to Samsung/Google’s premium ecosystems, and domestic chip/display breakthroughs, the supply chain matures rapidly. As tech, pricing, and UX barriers fall, smart glasses could become the next defining digital terminal after smartphones.